What does leveraged buyout mean?

Definitions for leveraged buyout

lever·aged buy·out

This dictionary definitions page includes all the possible meanings, example usage and translations of the word leveraged buyout.

Princeton's WordNet

leveraged buyoutnoun

a buyout using borrowed money; the target company's assets are usually security for the loan

"a leveraged buyout by upper management can be used to combat hostile takeover bids"

Wiktionary

leveraged buyoutnoun

A transaction in which a business firm, or a controlling share of a firm, is purchased using money which was borrowed by pledging all or some of the firm's assets as collateral.

Wikipedia

Leveraged buyout

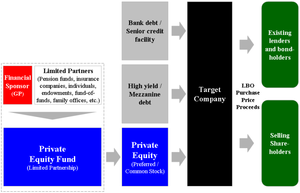

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – public-to-private). As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations in which companies were "over-leveraged", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business to the lenders.

ChatGPT

leveraged buyout

A leveraged buyout (LBO) is a strategy where a company is acquired by another entity or individual using a significant amount of borrowed funds to meet the acquisition costs. These borrowed funds may include bonds or loans. The collateral for these borrowed funds often includes the assets of the company being acquired and the assets of the acquiring company. The expectation is that the borrowing will pay for itself through the future cash flows or the sale of assets of the acquired company.

Wikidata

Leveraged buyout

leveraged buyout is acquisition where the purchase price is financed through a combination of equity and debt and in which the cash flows or assets of the target are used to secure and repay the debt. In other words, the acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition. Since the debt, be it senior or mezzanine, always has a lower cost of capital than the equity, the returns on the equity increase with increasing debt. The debt thus effectively serves as a lever to increase returns which explains the origin of the term LBO. LBOs are a very common occurrence in today's "Mergers and Acquisitions" environment. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as Management Buy-out, Management Buy-in, secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies.

Matched Categories

Numerology

Chaldean Numerology

The numerical value of leveraged buyout in Chaldean Numerology is: 6

Pythagorean Numerology

The numerical value of leveraged buyout in Pythagorean Numerology is: 3

Examples of leveraged buyout in a Sentence

There’s been little in the way of traditional LBO (leveraged buyout) activity, and what little there has been in the way of new money new issuance has been corporate to corporate activity, m&A activity is approaching record levels, exceeding the 2007 pace, so there are lots of deals happening but unfortunately they are at price points where most of the private equity sponsor community really can’t compete.

Basically what Chief Financial Officer Rajesh Kalathur’re seeing in the stock market is a slow-motion leveraged buyout of the entire market.

Translations for leveraged buyout

From our Multilingual Translation Dictionary

- الاستحواذ بالرافعة الماليةArabic

Get even more translations for leveraged buyout »

Translation

Find a translation for the leveraged buyout definition in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Word of the Day

Would you like us to send you a FREE new word definition delivered to your inbox daily?

Citation

Use the citation below to add this definition to your bibliography:

Style:MLAChicagoAPA

"leveraged buyout." Definitions.net. STANDS4 LLC, 2024. Web. 25 Apr. 2024. <https://www.definitions.net/definition/leveraged+buyout>.

Discuss these leveraged buyout definitions with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In