What does value added tax mean?

Definitions for value added tax

val·ue added tax

This dictionary definitions page includes all the possible meanings, example usage and translations of the word value added tax.

Did you actually mean value-added tax or valdez?

Wiktionary

value added taxnoun

A tax levied on the added value that results from the exchange of goods and services.

Wikipedia

Value Added Tax

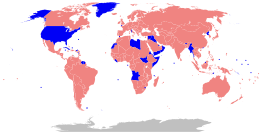

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues both worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD).: 14 As of 2018, 174 of the 193 countries with full UN membership employ a VAT, including all OECD members except the United States,: 14 where many states use a sales tax system instead. There are two main methods of calculating VAT: the credit-invoice or invoice-based method and the subtraction or accounts-based method. In the credit-invoice method, sales transactions are taxed, the customer is informed of the VAT on the transaction, and businesses may receive a credit for the VAT paid on input materials and services. The credit-invoice method is by far the more common and is used by all national VATs except for Japan. In the subtraction method, a business at the end of a reporting period calculates the value of all taxable sales, subtracts the sum of all taxable purchases, and applies the VAT rate to the difference. The subtraction method VAT is currently used only by Japan although it, often by using the name "flat tax," has been part of many recent tax reform proposals by US politicians. With both methods, there are exceptions in the calculation method for certain goods and transactions that are created to help collection or to counter tax fraud and evasion.

Wikidata

Value added tax

A value added tax is a form of consumption tax. From the perspective of the buyer, it is a tax on the purchase price. From that of the seller, it is a tax only on the value added to a product, material, or service, from an accounting point of view, by this stage of its manufacture or distribution. The manufacturer remits to the government the difference between these two amounts, and retains the rest for themselves to offset the taxes they had previously paid on the inputs. The purpose of VAT is to incentivise the production of critical resources required to sustain an economy, in the form of VAT-exempt goods. In the absence of VAT, an economy may tend towards production of services that can not sustain it – i.e., if all farmers became lawyers, everyone would starve. VAT also incentivises businesses to spend on expanding their operations, as much of the expenditure on expansion can be deducted from the VAT payable to the revenue service. The value added to a product by or with a business is the sale price charged to its customer, minus the cost of materials and other taxable inputs. A VAT is like a sales tax in that ultimately only the end consumer is taxed. It differs from the sales tax in that, with the latter, the tax is collected and remitted to the government only once, at the point of purchase by the end consumer. With the VAT, collections, remittances to the government, and credits for taxes already paid occur each time a business in the supply chain purchases products.

Editors Contribution

Numerology

Chaldean Numerology

The numerical value of value added tax in Chaldean Numerology is: 4

Pythagorean Numerology

The numerical value of value added tax in Pythagorean Numerology is: 7

Examples of value added tax in a Sentence

They pour their products onto markets without even paying value-added tax, and hardly any other tax at all, it is intolerable. On the same turnover they should pay the same tax.

I advise the government to further lower value-added tax, and if implemented, it will effectively boost the profit-making ability of the manufacturing industry.

These include direct subsidies, soft loans from state banks, VAT (value-added tax) rebates on some product categories, energy and input subsidies, and occasionally direct grants, among others.

While it is clearly an important result, it is only one feature in a universe of other measures that China foresees for its steel sector, these include direct subsidies, soft loans from state banks, VAT (value-added tax) rebates on some product categories, energy and input subsidies, and occasionally direct grants, among others.

It is a totally pointless complaint from the U.S. and it's biased against China, china's steel industry is market-based and Chinese steel products have good quality, low price and good service. The complaint on government subsidies is also crap. It's just we have a different system and we charge the 17 percent value-added tax and then return a portion of it.

Translations for value added tax

From our Multilingual Translation Dictionary

Get even more translations for value added tax »

Translation

Find a translation for the value added tax definition in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Word of the Day

Would you like us to send you a FREE new word definition delivered to your inbox daily?

Citation

Use the citation below to add this definition to your bibliography:

Style:MLAChicagoAPA

"value added tax." Definitions.net. STANDS4 LLC, 2024. Web. 3 May 2024. <https://www.definitions.net/definition/value+added+tax>.

Discuss these value added tax definitions with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In