What does credit default swap mean?

Definitions for credit default swap

cred·it default swap

This dictionary definitions page includes all the possible meanings, example usage and translations of the word credit default swap.

Wiktionary

credit default swapnoun

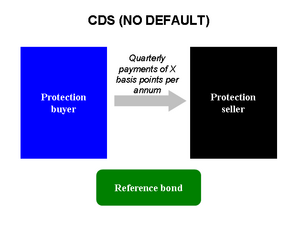

A credit derivative contract between two counterparties, whereby the buyer (seller of risk) makes periodic payments to the seller (buyer of risk) in exchange for the right to a payoff if there is a default or other credit event in respect of a third party called reference entity.

Wikipedia

Credit default swap

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to receive a payoff if the asset defaults. In the event of default, the buyer of the credit default swap receives compensation (usually the face value of the loan), and the seller of the CDS takes possession of the defaulted loan or its market value in cash. However, anyone can purchase a CDS, even buyers who do not hold the loan instrument and who have no direct insurable interest in the loan (these are called "naked" CDSs). If there are more CDS contracts outstanding than bonds in existence, a protocol exists to hold a credit event auction. The payment received is often substantially less than the face value of the loan.Credit default swaps in their current form have existed since the early 1990s and increased in use in the early 2000s. By the end of 2007, the outstanding CDS amount was $62.2 trillion, falling to $26.3 trillion by mid-year 2010 and reportedly $25.5 trillion in early 2012. CDSs are not traded on an exchange and there is no required reporting of transactions to a government agency. During the 2007–2010 financial crisis the lack of transparency in this large market became a concern to regulators as it could pose a systemic risk. In March 2010, the Depository Trust & Clearing Corporation (see Sources of Market Data) announced it would give regulators greater access to its credit default swaps database. There is "$8 trillion notional value outstanding" as of June 2018.CDS data can be used by financial professionals, regulators, and the media to monitor how the market views credit risk of any entity on which a CDS is available, which can be compared to that provided by the Credit Rating Agencies. Most CDSs are documented using standard forms drafted by the International Swaps and Derivatives Association (ISDA), although there are many variants. In addition to the basic, single-name swaps, there are basket default swaps (BDSs), index CDSs, funded CDSs (also called credit-linked notes), as well as loan-only credit default swaps (LCDS). In addition to corporations and governments, the reference entity can include a special purpose vehicle issuing asset-backed securities.Some claim that derivatives such as CDS are potentially dangerous in that they combine priority in bankruptcy with a lack of transparency. A CDS can be unsecured (without collateral) and be at higher risk for a default.

Wikidata

Credit default swap

A credit default swap is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event. The buyer of the CDS makes a series of payments to the seller and, in exchange, receives a payoff if the loan defaults. It was invented by Blythe Masters from JP Morgan in 1994. In the event of default the buyer of the CDS receives compensation, and the seller of the CDS takes possession of the defaulted loan. However, anyone can purchase a CDS, even buyers who do not hold the loan instrument and who have no direct insurable interest in the loan. If there are more CDS contracts outstanding than bonds in existence, a protocol exists to hold a credit event auction; the payment received is usually substantially less than the face value of the loan. Credit default swaps have existed since the early 1990s, and increased in use after 2003. By the end of 2007, the outstanding CDS amount was $62.2 trillion, falling to $26.3 trillion by mid-year 2010 but reportedly $25.5 trillion in early 2012. CDSs are not traded on an exchange and there is no required reporting of transactions to a government agency. During the 2007-2010 financial crisis the lack of transparency in this large market became a concern to regulators as it could pose a systemic risk. In March 2010, the [DTCC] Trade Information Warehouse announced it would give regulators greater access to its credit default swaps database.

Numerology

Chaldean Numerology

The numerical value of credit default swap in Chaldean Numerology is: 5

Pythagorean Numerology

The numerical value of credit default swap in Pythagorean Numerology is: 7

Examples of credit default swap in a Sentence

The CDS (credit default swap) market is indicating a future financial stress for bond holders in the banking sector. There are concerns that the banking sector is under-capitalised in Europe and credit conditions are sub-optimal, and when combined that with the global macro backdrop, with Chinese growth slowing down, there is a natural impact of it around the world and the banking sector is bearing the brunt. There could be a wave of defaults in the energy sector and that will damage the balance sheet of the banking sector.

The CDS (credit default swap) market is indicating a future financial stress for bond holders in the banking sector. There are concerns that the banking sector is under-capitalised in Europe and credit conditions are sub-optimal, and when combined with the global macro backdrop, with Chinese growth slowing down, there is a natural impact of it around the world and the banking sector is bearing the brunt. There could be a wave of defaults in the energy sector and that will damage the balance sheet of the banking sector.

The CDS (credit default swap) market is indicating a future financial stress for bond holders in the banking sector. There are concerns that the banking sector is undercapitalised in Europe and credit conditions are sub-optimal, combined with the global macro backdrop, with Chinese growth slowing down, there is a natural impact around the world and the banking sector is bearing the brunt. There could be a wave of defaults in the energy sector and that will damage the balance sheet of the banking sector.

Translation

Find a translation for the credit default swap definition in other languages:

Select another language:

- - Select -

- 简体中文 (Chinese - Simplified)

- 繁體中文 (Chinese - Traditional)

- Español (Spanish)

- Esperanto (Esperanto)

- 日本語 (Japanese)

- Português (Portuguese)

- Deutsch (German)

- العربية (Arabic)

- Français (French)

- Русский (Russian)

- ಕನ್ನಡ (Kannada)

- 한국어 (Korean)

- עברית (Hebrew)

- Gaeilge (Irish)

- Українська (Ukrainian)

- اردو (Urdu)

- Magyar (Hungarian)

- मानक हिन्दी (Hindi)

- Indonesia (Indonesian)

- Italiano (Italian)

- தமிழ் (Tamil)

- Türkçe (Turkish)

- తెలుగు (Telugu)

- ภาษาไทย (Thai)

- Tiếng Việt (Vietnamese)

- Čeština (Czech)

- Polski (Polish)

- Bahasa Indonesia (Indonesian)

- Românește (Romanian)

- Nederlands (Dutch)

- Ελληνικά (Greek)

- Latinum (Latin)

- Svenska (Swedish)

- Dansk (Danish)

- Suomi (Finnish)

- فارسی (Persian)

- ייִדיש (Yiddish)

- հայերեն (Armenian)

- Norsk (Norwegian)

- English (English)

Word of the Day

Would you like us to send you a FREE new word definition delivered to your inbox daily?

Citation

Use the citation below to add this definition to your bibliography:

Style:MLAChicagoAPA

"credit default swap." Definitions.net. STANDS4 LLC, 2024. Web. 19 Apr. 2024. <https://www.definitions.net/definition/credit+default+swap>.

Discuss these credit default swap definitions with the community:

Report Comment

We're doing our best to make sure our content is useful, accurate and safe.

If by any chance you spot an inappropriate comment while navigating through our website please use this form to let us know, and we'll take care of it shortly.

Attachment

You need to be logged in to favorite.

Log In